2026 has kicked off on the front foot with a positive data point – sentiment among civil contractors, as measured by the FNB/BER Civil Confidence Index rose to a joint 11-year high in 2025Q4. The improvement in the business mood was supported by significantly better readings for activity growth and overall profitability.

With business activity on the up, we can expect demand for Working Capital, Expansion Capital and Trade Finance to increase.

Each month, our team casts its eye over the industry to look for trends. Here are some that we are aware of:

1. Agriculture and DTIC grants dominate our digital channels

As a strategic advisory firm, we look to lean into our data to help inform our decision-making and understand trends in the working capital space.

Looking at our Google Search Console data, we see a couple of recurring themes when it comes to our audience. These include the following search phrases:

- “DTI grants for agriculture”

- “Agro-Processing Support Scheme”

- “DTI funding requirements”

- “Flexible working capital loan companies for SMEs in South Africa”

- “Grindstone Accelerator Knife Capital South Africa”

Our two most visited website pages in January have been:

Agro-processing is also a sector identified by SEDFA and Tyme Bank

TymeBank is one of South Africa’s fastest growing banking groups and following its acquisition of Retail Capital, this institution has a clear line-of-sight on the economy.

They recently noted in their forecasts for 2026:

“SMEs in growth sectors such as renewable energy, tech-enabled services, and agro-processing are benefitting from targeted government incentives to drive innovation and create new export opportunities to meet evolving market needs.”

They also noted on the regulatory side some positive developments:

“The regulatory environment is evolving, with several developments set to impact SMEs directly. The government’s ongoing efforts to streamline business registration and tax compliance are expected to bear fruit in early 2026. “

3. Bridgement is unlocking funding for SMEs

Are SMEs actually unlocking funding and working capital in South Africa?

Based on the feedback from our partners at Bridgement, the answer is “yes!”

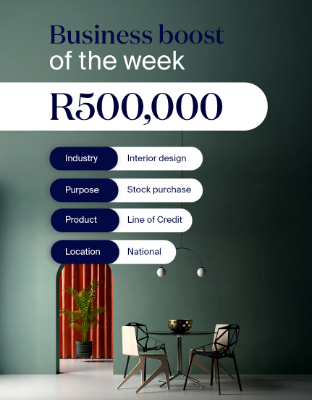

These are 2 of the featured businesses who were recently funded:

Bridgement offers funding of between R20 000 and R5m and can process your application within 72 hours. If you would like to open a Bridgement account, click here.

New Research, Development and Innovation Incentives Guide

The Western Cape Government’s Department of Economic Development and Tourism has compiled a Research,Development and Innovation Incentives Guide that brings together 37+ national and private-sector programmes supporting business growth, technology development and innovation.

The booklet outlines key details for each incentive including the administering agency, objectives, eligibility criteria, funding amounts and application links making it easier for companies, SMMEs, startups and support organisations to find the right instruments for R&D, commercialisation, infrastructure, skills and venture funding.

Highlighted programmes span:

➡️ Enterprise and broad-based development (e.g. BBSDP, CIS, Jobs Fund)

➡️ Technology and commercialisation (e.g. Commercialisation Support Fund, SPII, Seed Fund, TIA instruments)

➡️ Tax and strategic incentives (e.g. R&D Tax Incentive, Section 11D, SPP)

➡️ Venture capital and impact funds (e.g. Hlayisani Venture Fund II, SA SME Fund, TVC)

➡️ Sector and location-focused incentives (e.g. City-level investment incentives, green tech, manufacturing).

The guide is intended as a navigation tool for organisations seeking financial or strategic support for R&D and innovation initiatives, and users are encouraged to verify details directly with funders and ensure they are consulting the latest version of the document.

More Info is available here.

Looking to access Working Capital for your business?

If you are an SME looking to access Working Capital, Trade Finance, Lines of Credit or more strategic funding, we have a specialist team on hand to assist you.

We bring together years of experience and partners who have analysed thousands of SMEs.

If you would like assistance, please do not hesitate to contact us.